Investment Process & Strategy

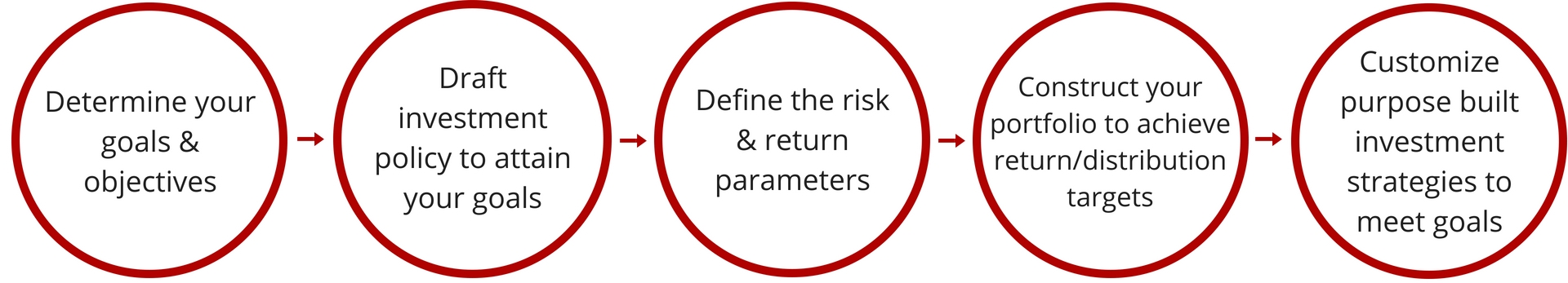

A strong investment process assists you in meeting investment challenges and opportunities over your investment horizon. It must provide income replacement and asset protection in the event that the unthinkable were to happen: disability, critical illness, or death. It is crucial to create a financial plan that seeks to protect your needs now and plans for the future in a tax-efficient manner.

It is our goal to assist you in building a solid financial structure that will grow and build wealth for you and your family. With these goals in mind, we will work together to assess your total financial planning needs. We will consider important milestones such as major purchases, marriage, children, education, dreams, and retirement. We will then take the time to understand each client's goals, risk tolerance, income requirements, tax position, and time horizon before creating a strategy.

This cash flow approach is designed to help you:

- Define customized short and long-term goals that ensure you to choose only the right financial products and services

- Identify roadblocks or gaps that might impact your strategies

- Continually monitor your progress to ensure that it meets your changing needs

On a continual basis we:

- Review customized benchmarks to measure our progress

- Determine how existing assets and strategies fit the overall objective

- Propose strategies and programs designed to meet or exceed objectives

Personal attention to detail is the core of our approach. Through frequent face-to-face or virtual meetings, we refine client objectives and develop guidelines for asset allocation and investment goals. We design specific strategies to attain goals within your overall financial plan using our exhaustive valuation model. We consider components including tax issues, liquidity requirements, asset class preference, investment time period, and return expectations. We believe that in the long run, a well-diversified portfolio constructed for consistent performance will serve clients better than a single strategy. That said, we are constantly increasing and de-emphasizing different strategies within clients’ overall portfolios given their risk tolerance and changing markets. We construct portfolios with a broad mix of equity, fixed income, and commodity-based securities strategies. We do not limit ourselves to any one asset class or sector, but believe value can be found in all areas of the markets.

We will make sure that you understand the recommendations we make and are comfortable with them before we move forward as a team in order to ensure your financial well-being.